IFSC Code State Bank Of India Lookup: MICR Codes & Addresses for All State Bank Of India Branches

SBI IFSC Code: MICR Code and Branch Addresses of State Bank of India

Every branch of the State Bank of India (SBI) in India has a distinct code called Institute Financial Service Code, or IFSC Code. This code allows online money transfers to SBI Bank account holders. Each SBI Bank branch has a code provided by the Reserve Bank of India (RBI) to commence transactions involving Real-Time Gross Settlements (RTGS) and National Electronic Fund Transfers for all SBI Bank branches and SBI customers.

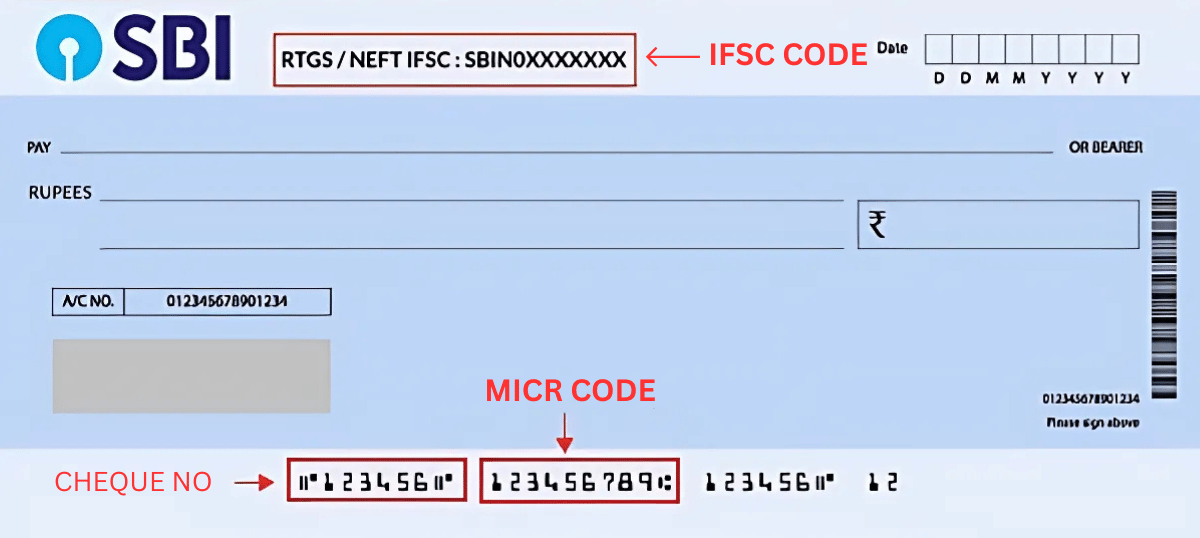

For online money transfers, the SBI IFSC Code is an 11-character unique alpha-numeric code. This code will be used to initiate a NEFT, RTGS, or IMPS transfer. The first four characters in the IFSC code represent the bank name which is given to the bank by RBI. SBIN is the first four letters that are given by the RBI to the State Bank of India.

Information Needed to Transfer Funds

Customers of the State Bank of India would need to provide the information below to perform an NEFT/RTGS transaction.

- The amount of money needs to be transferred

- The name of the beneficiary's Bank.

- The name of the beneficiary

- The beneficiary's account number

- Information sent to the beneficiary

- The IFSC code of the beneficiary Bank branch

Where to find SBI MICR and IFSC Codes?

It's quite easy to find your State Bank of India branch's IFSC and MICR code. For example, if you have an account at State Bank India, your branch code sbi is printed on the front page of your bank passbook and also on your chequebook. Of course, you can use your IFSC CODE SBI at any time, for wire transfers or RTGS, NEFT, or IMPS.

In order to provide continuity in the banking facility, SBI updated its IFSCs internally. The old checkbooks will no longer be valid. Hence customers who have an account in these banks must reapply the chequebooks. Here is the main sbi ifsc code list:

| Formerly Associated Bank |

Old IFSC Cod |

New IFSC Code (SBI) |

| State Bank of Mysore |

SBMY0040001 |

SBIN00440001 |

| State Bank of Bikaner & Jaipur (SBBJ) |

SBBJ0010001 |

SBIN0031001 |

| State Bank of Hyderabad |

SBHY0020001 |

SBIN0020001 |

| State Bank of Patiala |

STBP0000001 |

SBIN0050001 |

| State Bank of Travancore |

SBTR0000001 |

SBIN0070001 |

How to use RTGS, IMPS, and NEFT systems to transfer money from SBI Bank account?

SBI has several options to allow safe financial transactions for other SBI Bank branches and other bank branches across India. To transfer money, SBI allows customers to use RTGS, IMPS, and NEFT. All these methods require sbi ">bank ifsc code for fund transfer.

1. National Electronic Funds Transfer (NEFT)

SBI introduced an electronic fund transfer system named e-Monies National Electronic Funds Transfer/ National Electronic Funds Transfer (NEFT). NEFT is an electronic fund transfer facility that allows money transferred easily, quickly, and safely. There is no limit to the amount of money that can be transferred using NEFT for SBI branches. SBI follows a schedule for processing online NEFT transactions which means your NEFT transactions will only be processed at the scheduled time irrespective of the time you have booked it and the scheduled time is decided by the SBI itself.

2. Gross Settlement in Real Time (RTGS)

Real Time Gross Settlement which is called (RTGS) is an ultra-fast way to transfer money in real-time. Because there are no interbank settlement issues or clearing house issues, these transactions have much faster settlement cycles. RTGS transactions are not limited to India, you can send money abroad also. Transactions made from a home branch are unlimited in any capacity.

3. Immediate Payment Service (IMPS)

SBI offers Immediate Payment Service, an inter-bank electronic money transfer service that is a completely hassle-free service. Account holders can send and receive money with IMPS on weekdays, Sundays, and bank holidays. IMPS transfers allow the beneficiary to receive a credit to their account within seconds.

Conclusion

The sbi branch code is a very important part of any electronic fund transfer system in India and helps to make sure online money transfers to SBI or other bank accounts are safe and simple to do. Account holders must use the new IFSC CODE SBI and also get a new chequebook to support the use of banking services after the merger. SBI provides its customers with flexibility and trust when it comes to banking services. For fund transfers, it offers its customers various channels, NEFT, RTGS, and IMPS, which makes the services flexible and secure.

Frequently Asked Questions

1. What is an IFSC code?

Every Indian bank branch has a unique 11-character alphanumeric identifier, you guessed it, called an IFSC (Indian Financial System Code) used for online money transfers.

2. What do the first four characters of sbi bank code mean?

The first four characters of an IFSC code for a State Bank of India (SBI) branch will always start with the four characters of "SBIN" which contains the name of the bank.

3. Where will I find the IFSC code and MICR code of SBI branch?

The IFSC and MICR codes are on the first page of your check book and your bank passbook.

4. Why aren't old checkbooks from SBI banks that were former affiliates valid anymore?

Old checkbooks may not be valid because of private internal changes to SBI's IFSC codes under its merger with banks that were once affiliated with SBI - all account holders have to apply for new checkbooks.

5. What is the difference between NEFT, RTGS, and IMPS in terms of transfers with SBI?

RTGS is for a large-value instant transfer in high-value sending with instant confirmation and has no limit so there is instant confirmation, IMPS (immediate payment across banks) is instant and can happen 24/7 even on holidays and NEFT is a transaction done many in a batch type method and no limits apply at SBI branches, however, if you bank with on-line net-banking there will be limits.